You might think that handling insurance claims after an accident is a clear-cut affair. After all, isn’t insurance meant to offer financial safety when you most need it? Yet, behind the curtain, insurance claim adjusters are diligently safeguarding their company’s financial interests. They are not there to help you. This piece sheds light on the covert strategies of insurance claim adjusters and offers crucial tips to effectively counter them.

The Insurance Claim Adjuster’s Role

Insurance claim adjusters, hired by insurance firms, assess the legitimacy and worth of claims. Their role involves assessing the circumstances surrounding an accident, compiling evidence, and negotiating settlements on behalf of the insurance company.

With a deep understanding of the claims procedure, these adjusters present a significant challenge. They aim to reduce payouts and safeguard the insurer’s financial interests, which may not always align with your best interests.

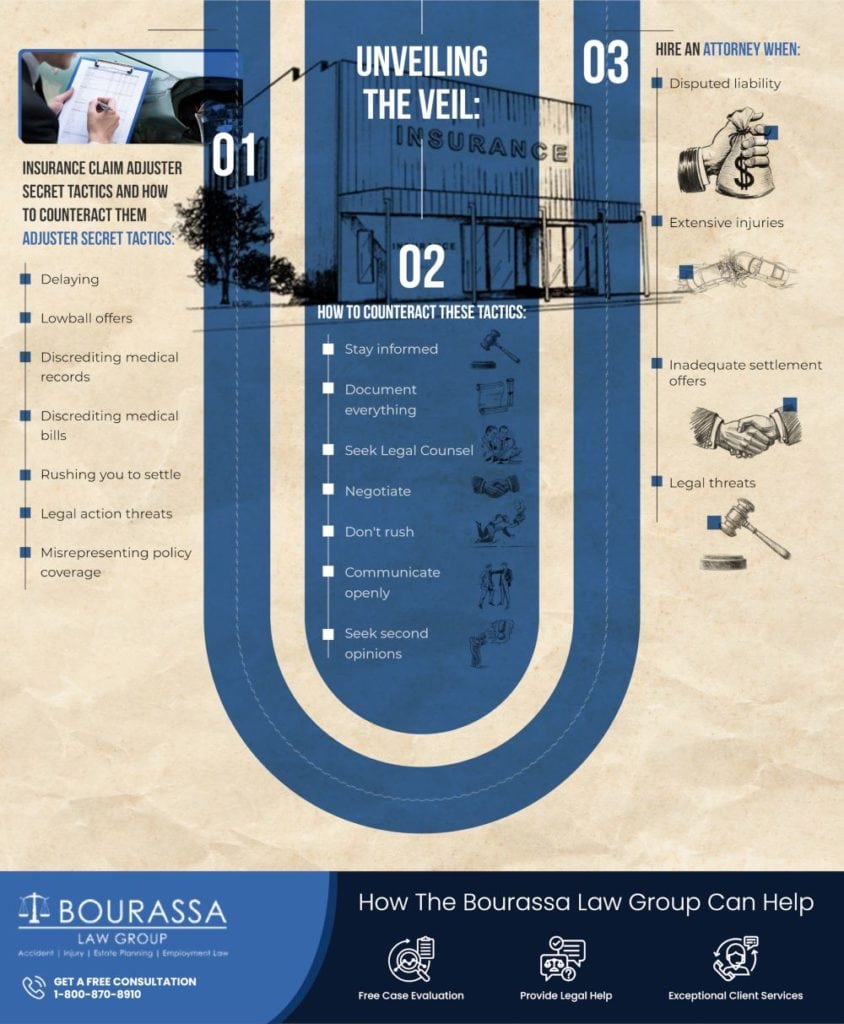

Understanding Insurance Claim Adjuster Secret Tactics

Insurance claim adjusters are rife with strategies and tactics designed to reduce payouts. For a just settlement, it’s vital to recognize these maneuvers and counter them effectively. Here are some of the secret tactics used by insurance claim adjusters:

Quick Settlement Offers

Insurance adjusters sometimes give you a quick settlement offer immediately after the accident. This might seem like an easy way to resolve your accident, but the amount of any settlement offer is likely far too low to compensate you for your losses. They are counting on you not to know that.

Delay Tactics

One of the oldest tricks in the book is to employ delay tactics. Adjusters might intentionally prolong the claims procedure, hoping claimants, out of sheer frustration, settle for a lesser amount. The longer it takes to resolve your claim, the more likely you will settle for less than what’s fair.

Lowball Offers

Insurance claim adjusters are experts in offering lowball settlements. Their starting offer might be significantly below your claim’s actual worth hoping that you’ll accept it to avoid the hassle of extended negotiations. Be wary of such offers, and don’t hesitate to push back.

Discrediting Medical Records

Medical records are a crucial component of any accident claim. Adjusters might try undermining your medical records, implying either that your injuries aren’t as grave as stated or that they stem from prior conditions. Maintaining a clear and transparent medical record is key to countering such maneuvers.

Undervaluing Medical Bills

Another tactic involves undervaluing your medical bills. Adjusters might question the need for specific treatments or try to haggle for reduced medical service fees. You might hear a claim that the charges are not reasonable or customary for the area. Make sure every medical bill is meticulously recorded and stand firm against efforts to belittle them.

Rushing You to Settle

Adjusters frequently face the heat of wrapping up cases quickly. They may rush you towards a settlement, particularly if they detect financial stress from medical expenses and other costs on your end. Stand your ground against such urgency and allocate ample time to assess their proposal.

Threatening Legal Action

Some adjusters might resort to intimidation, suggesting potential legal repercussions if you decline their offer. While legal action is a possibility, it’s not a decision that should be taken lightly. You do not need to be afraid of lawsuit. You should consider consulting an attorney to understand your options.

Misrepresenting Policy Coverage

Adjusters might sometimes withhold full details about the policy’s coverage. They might conveniently leave out certain terms or caps that might influence your claim’s worth. Don’t hesitate to request a full disclosure of policy details.

How to Counteract Insurance Claim Adjuster Secret Tactics

Understanding these secret tactics is pivotal in seeking fair compensation. Now, it’s time to explore how to counteract them effectively.

Stay Informed

To counter adjuster strategies, arm yourself with comprehensive knowledge about the claims procedure, your policy, and your rights. Knowledge is your best defense, so take the time to understand the terms and conditions of your policy.

Document Everything

From the moment the accident occurs, document every detail meticulously. Take photos, collect contact information from witnesses, and maintain a thorough record of all medical expenses and treatments. The more evidence you have the more information you will have to work with during negotiations.

Seek Legal Counsel

Facing the complex realm of insurance claims often warrants hiring an attorney. An experienced attorney has experience in working with these insurance adjusters and can guide you through the process, protect your interests, and ensure you receive a fair settlement. Some attorneys have even worked with insurance companies before they started representing injured people, like the attorneys at The Bourassa Law Group. BLG’s attorneys use the knowledge they gained while working with insurance companies and use it to their advantage when representing their claims against insurance companies and the tactics they use.

Don’t Rush the Process

Resist the temptation to settle quickly. Take your time to assess the full extent of your injuries and losses. Rushing into a settlement may leave you undercompensated for your suffering.

Be Prepared to Negotiate

Expect that the initial offer will be lower than your rightful claim. Be prepared to negotiate, and confidently counter with evidence and arguments to support your claim.

Maintain Open Communication

Maintaining open and honest communication with the adjuster is essential. While you shouldn’t withhold information, refrain from offering more than required. Keep your conversations focused on the facts.

Be Patient and Persistent

Patience and persistence can be your strongest allies. Don’t give in to frustration; continue pushing for a fair settlement. While adjusters might challenge your determination, staying the course can yield a more favorable result.

Seek a Second Opinion

Should you have doubts about your claim or the adjuster’s evaluation, consider seeking a second opinion from an attorney, another adjuster or a trusted expert in the field.

When to Hire an Attorney

Hiring an attorney is a significant decision, one that should be made with careful consideration. It is essential to understand the specific circumstances in which seeking legal representation is not only advisable but can significantly benefit your insurance claim process. Here are further details on when to hire an attorney:

Complex Cases:

In cases involving complexity, an attorney’s expertise proves indispensable. These complexities can take various forms:

Multiple Parties: When multiple parties are involved in the accident, the situation can become convoluted. Each party may have its own insurance company and adjusters, complicating negotiations. An attorney can help you navigate the complexities of dealing with multiple parties and their insurers. They can ensure that all responsible parties are held accountable for their share of liability.

Extensive Injuries: If the injuries resulting from the accident are severe and require ongoing medical treatment, surgeries, or rehabilitation, the financial stakes amplify. You’ll need an attorney to calculate the long-term costs and ensure you receive compensation that covers all your medical bills and future care. They can also help you consider non-economic damages, such as pain and suffering.

Disputed Liability:

Disputed liability arises when parties can’t concur on who bears the blame for the accident. To determine liability, you might need to answer intricate legal questions about fault and causation. In such cases, an attorney can offer significant advantages:

Gathering Evidence: Your attorney will work to gather the necessary evidence to support your version of events and highlight the other party’s liability. This may involve collecting witness statements, obtaining surveillance footage, or consulting accident reconstruction experts.

Negotiating Settlements: Even if the liability is disputed, settling outside of court often aligns with the best interests of all parties involved. Your attorney can negotiate on your behalf to secure a fair settlement that reflects the strength of your case.

Inadequate Settlement Offers:

At times, insurance adjusters persistently propose settlements that fall short of genuinely representing your claim’s worth. Under these circumstances, hiring an attorney can be a wise decision:

Evaluating Claim Value: An attorney can thoroughly assess the value of your claim based on the specifics of your case, including medical bills, property damage, lost wages, and non-economic damages. They ensure you receive a settlement that adequately covers your current and future costs.

Effective Negotiation: With their expertise and adeptness, attorneys can adeptly negotiate with insurance companies. They can challenge lowball offers, present compelling arguments, and work to reach a fair and just settlement.

Legal Threats:

When an insurance adjuster threatens you with legal action, it’s a critical moment that necessitates legal representation:

Providing Legal Guidance: While legal intimidations can be daunting, an attorney stands ready to guide you through. They can advise you on whether it’s in your best interest to settle, engage in further negotiations, or prepare for litigation.

Litigation Preparation: Should legal proceedings become unavoidable, your attorney can prepare your case for the courtroom. This includes gathering additional evidence, preparing legal documents, and representing your interests in the courtroom.

BLG’s Finest Attorneys Can Help You Win a Fair Compensation

Dealing with insurance claim adjusters can be a challenging experience, as they employ secret tactics to minimize payouts. However, by understanding their strategies and taking the appropriate countermeasures, you can level the playing field and work towards securing a fair settlement. Remember, knowledge, preparation, and persistence are your strongest allies in this process. In cases where the complexities of the claims process become overwhelming, hiring an attorney may be the best way to protect your rights and ensure you receive the compensation you deserve. Don’t let the veil of insurance claim adjuster tactics obscure your path to a just compensation.

Hiring an attorney for your insurance claim? BLG’s top-rated attorneys are by your side. We assess your case, offer the best course of action, and guide you through the complex legal process.

Want to book an appointment for a free consultation? Give us a call today and discuss your case.