Working under the table: it’s a term often whispered in hushed tones, associated with secrecy, quick cash, and avoiding the prying eyes of the taxman. But what exactly does it mean? And more importantly, what happens if you get caught?

If you’ve ever found yourself in the murky waters of off-the-books employment, you’re not alone. Many individuals, for various reasons, choose to work under the table, receiving cash payments for their services without the involvement of official documentation or taxation. However, what may seem like a convenient arrangement can quickly turn into a legal nightmare if discovered.

Understanding the Term: What Does Working “Under the Table” Mean?

Working under the table refers to employment situations where individuals are paid in cash for their services, with no official records or taxes withheld or reported to government agencies. It’s a way for employers to skirt around employment laws and avoid paying taxes, often leaving employees vulnerable and unprotected.

Is It Illegal to Get Paid or Work Under the Table?

In short, yes, it’s illegal. While the allure of quick cash may be tempting, both employers and employees can face severe consequences for engaging in under-the-table arrangements. From a legal standpoint, working under the table violates various employment and tax laws, including:

Employment Laws: Under-the-table employment often violates labor laws, including minimum wage requirements, overtime pay regulations, and workplace safety standards. Without official records, employees may also be denied benefits such as workers’ compensation and unemployment insurance.

Tax Evasion: By not reporting income and withholding taxes, both employers and employees are committing tax evasion, a serious offense punishable by fines, penalties, and even criminal charges.

What Happens if You Get Caught Working Under the Table?

If you find yourself working under the table, it’s essential to understand the potential consequences if you get caught. While the allure of quick cash or avoiding taxes may seem tempting, the risks associated with under-the-table employment can have long-lasting repercussions. Here’s what happens if you’re caught working under the table:

Legal Penalties: Working under the table is illegal, and if caught, you may face legal repercussions such as fines, back taxes, and even criminal charges.

Tax Issues: Engaging in under-the-table work constitutes tax evasion, which can lead to substantial penalties imposed by the Internal Revenue Service (IRS) or state tax agencies.

Loss of Benefits: By not being officially employed, you miss out on important benefits such as social security, Medicare, unemployment insurance, and workers’ compensation. This can leave you financially vulnerable in case of illness, injury, or unemployment.

Limited Legal Protections: Without official employment records, you may struggle to assert your rights in cases of wage theft, workplace discrimination, or wrongful termination.

Professional Repercussions: Working under the table can damage your professional reputation and limit your career opportunities, as it may raise questions about your integrity and reliability.

Difficulty in Future Employment: Employers may be wary of hiring individuals with a history of working under the table, leading to challenges in securing legitimate employment in the future.

Social Stigma: There may be social stigma associated with working under the table, which can affect your self-esteem and social standing.

What Happens When Employees Are Paid Cash for Working Under the Table?

For employees, being paid cash under the table may seem like a straightforward transaction, but the ramifications can be far-reaching. Without official payroll taxes records, employees may find themselves:

Excluded from Employment Benefits: Working under the table means missing out on essential benefits such as health insurance, retirement plans, and unemployment benefits. In the event of injury or unemployment, individuals may struggle to access the support they need.

Facing Legal Consequences: If caught, employees can face fines, penalties, and even criminal charges for participating in under-the-table arrangements. Moreover, without official records of employment, proving wage theft or seeking recourse for workplace disputes becomes significantly more challenging.

Can I Sue My Employer for Paying Me Under the Table?

While it’s possible to pursue legal action against employers who engage in under-the-table payments, the process can be complex and challenging. Without official documentation, proving employment status, wages owed, and damages becomes an uphill battle. However, under certain circumstances, individuals may still be able to seek justice through:

Wage Claims: Employees can file wage claims with state labor departments or pursue civil litigation to recover unpaid wages, overtime, and other damages. However, success often hinges on the ability to provide credible evidence of employment and earnings.

Legal Representation: Seeking the guidance of an experienced employment attorney can significantly improve the chances of a successful wage claim. Attorneys can help gather evidence, navigate legal procedures, and advocate for fair compensation on behalf of their clients.

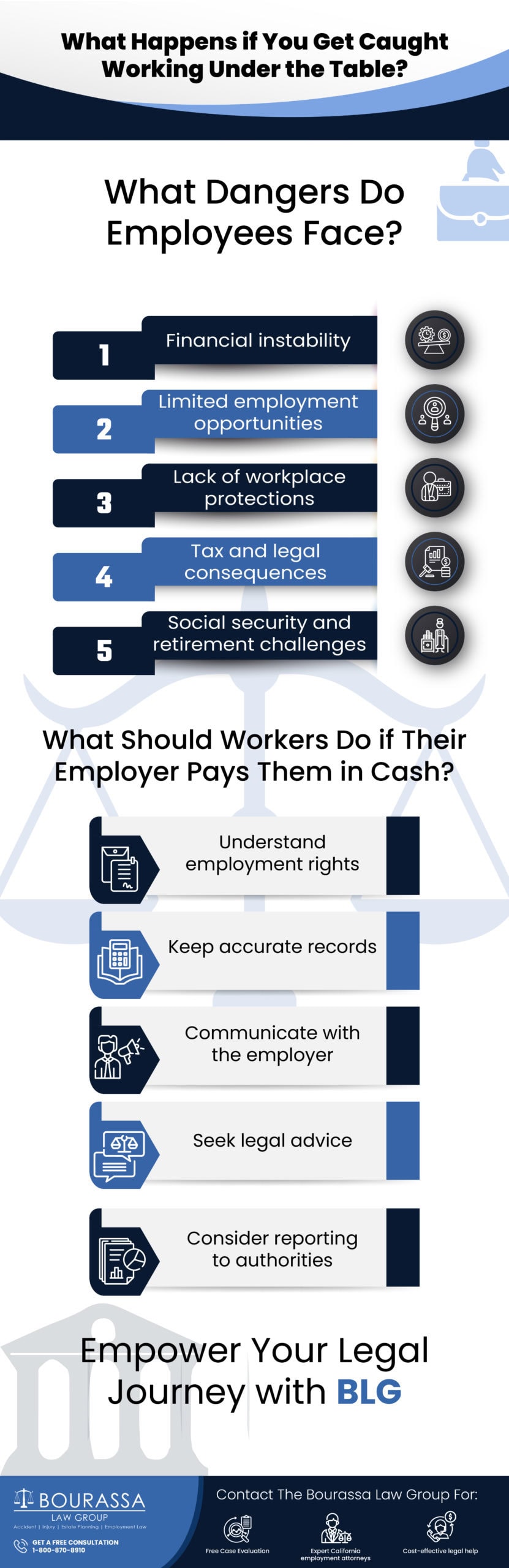

What Dangers Do Employees Face When Working Under the Table for Unreported Wages?

Working under the table may offer immediate financial benefits, but the long-term risks far outweigh the gains. Some of the dangers employees face include:

Financial Instability: Without official records or stable employment, individuals working under the table are vulnerable to sudden income loss, lack of benefits, and financial instability.

Legal Vulnerability: Engaging in under-the-table employment exposes individuals to legal risks, including fines, penalties, and criminal charges for tax evasion and labor violations.

Limited Employment Opportunities: With no official employment history or references, individuals working under the table may struggle to secure legitimate employment in the future, hindering career advancement and financial stability.

Lack of Workplace Protections: Workers are denied basic labor rights and face heightened risks of injury without adequate safety measures.

Tax and Legal Consequences: Engaging in tax evasion carries severe penalties, including fines and criminal prosecution.

Social Security and Retirement Challenges: Absence of contributions to Social Security jeopardizes future retirement benefits and healthcare coverage.

Stigmatization and Marginalization: Social stigma surrounding under-the-table work can affect mental well-being and hinder social integration.

How Does the IRS Find Out?

Despite its clandestine nature, under-the-table employment is not immune to scrutiny by government agencies like the Internal Revenue Service (IRS). The IRS employs various methods to identify instances of unreported income and tax evasion, including:

Data Matching: The IRS compares income reported by employers with individual tax returns to identify discrepancies and unreported income.

Whistleblower Reports: Individuals can report suspected tax evasion and under-the-table employment to the IRS through its whistleblower program, potentially leading to investigations and enforcement actions.

Audits and Investigations: The IRS conducts audits and investigations into suspected cases of tax evasion, employing forensic accounting, interviews, and other investigative techniques to uncover unreported federal income taxes.

What Should Workers Do if Their Employer Pays Them in Cash?

If workers find themselves in a situation where their employer pay them in cash, they should take the following steps:

Understand Employment Rights: Workers should familiarize themselves with their rights regarding wages, employment taxes including Social Security and Medicare taxes and employment benefits. It’s crucial to know what is legally required of employers in terms of payment and reporting.

Keep Accurate Records: Even if payment is made in cash, workers should maintain detailed records of their earnings, including dates, hours worked, and payment amounts. These records can serve as evidence in case of disputes or legal issues.

Communicate with the Employer: Workers should communicate openly with their employer about their concerns regarding cash payments. They can inquire about the reasons for why they pay employees in cash and request proper documentation of their gross wages.

Seek Legal Advice: If workers suspect that their employer is engaging in illegal or unethical practices by paying employees in cash, they should seek legal advice from an employment attorney. An attorney can help them understand their rights and options for recourse.

Consider Reporting to Authorities: In cases where the employer’s actions may be illegal, such as tax evasion or labor law violations, workers may choose to report the situation to relevant authorities, such as the Internal Revenue Service (IRS) or the Department of Labor.

How an Attorney Can Help You in Cases of Under-the-Table Employment

Engaging the services of an experienced attorney can be instrumental if you find yourself caught in a situation where you’ve been working under the table. Here’s how an attorney can assist you:

Legal Advice: Attorneys provide guidance on your rights and legal options in your situation.

Representation: They represent you in legal proceedings and negotiations with government agencies.

Settlement Negotiation: Attorneys can negotiate settlements to resolve legal issues related to working under the table.

Compliance Assistance: They help you comply with legal requirements when rectifying any discrepancies in your employment situation.

Protection from Retaliation: Attorneys safeguard you against potential retaliation from your employer for seeking legal assistance or reporting under-the-table payments.

Handling Employment Disputes: Attorneys assist with disputes arising from under-the-table employment, such as unpaid wages or wrongful termination.

Legal Representation for Employer Disputes: They represent you in legal actions against employers who engage in illegal employment practices, such as employer paying cash under the table.

Empower Your Legal Journey with BLG

In summary, working under the table may offer temporary financial gains, but the consequences far outweigh the benefits. From legal risks and financial instability to limited employment opportunities, individuals who engage in under-the-table arrangements expose themselves to a host of dangers. Moreover, employers who flout employment and tax laws face severe penalties, including fines, penalties, and criminal charges.

Therefore, it’s essential to understand the risks involved and seek legal guidance to ensure compliance with employment and tax regulations. Ultimately, honesty and transparency are the cornerstones of a stable and lawful employment relationship, benefiting both employers and employees in the long run.

If you’re facing legal issues related to working under the table or have questions about your rights as an employee, don’t hesitate to reach out to BLG. Our experienced attorneys are here to provide expert advice and representation tailored to your specific situation.

Contact us today for a confidential free consultation.

FAQs

What happens if you work under the table?

Working under the table means you’re employed off the books, without reporting income to tax authorities. Consequences can include legal penalties, loss of benefits, and difficulty proving income for loans or visas.

Can you get away with getting paid under the table?

While it’s possible to receive payment under the table without immediate detection, it’s not a sustainable or legal practice. There are risks of audits, fines, and legal repercussions for both the employer and employee.

Do you have to pay taxes if you get paid under the table?

Yes, you are still required to report and pay taxes on income earned under the table. Failure to do so constitutes tax evasion, which is illegal and punishable by employment law.