Car accidents are jarring experiences, leaving individuals shaken and grappling with the aftermath. The situation becomes more complex for those who have leased their vehicles, raising questions about the implications of their lease agreements and the intricate web of insurance coverage. Understanding the aftermath of a leased car accident is crucial in the vast expanse of Nevada, where the open roads invite both thrill-seekers and commuters alike.

In this article, we’ll explore how an accident can affect a car lease, shedding light on what happens if you crash a leased car, what to do afterward, and how legal guidance can navigate the complexities.

What To Do After an Accident With a Leased Car?

In the chaotic aftermath of a car accident, it’s crucial to follow a systematic approach, especially when dealing with a leased vehicle. Here’s a step-by-step guide on what to do after an accident with a leased car:

Ensure Safety and Check damages: Prioritize safety for all parties involved. If there are injuries, seek medical attention immediately. After a crash, check for damages and take your car to a body shop to determine whether it can be repaired.

Contact Law Enforcement: Call the police to the scene, ensuring a police report is filed. This document is crucial for insurance claims and legal proceedings.

Exchange Information: Collect contact and insurance information from all parties involved in the accident.

Document the Scene: Take pictures of the accident scene, including damages to all vehicles and any relevant road signs or signals.

Notify Your Leasing Company: Inform your leasing company about the accident promptly. They will guide you on the next steps and may have specific procedures to follow.

Contact Your Insurance Company: Report the accident to your insurance company, providing them with all the necessary information.

Understand Your Lease Agreement: Review your lease agreement to understand your responsibilities and obligations in the event of an accident.

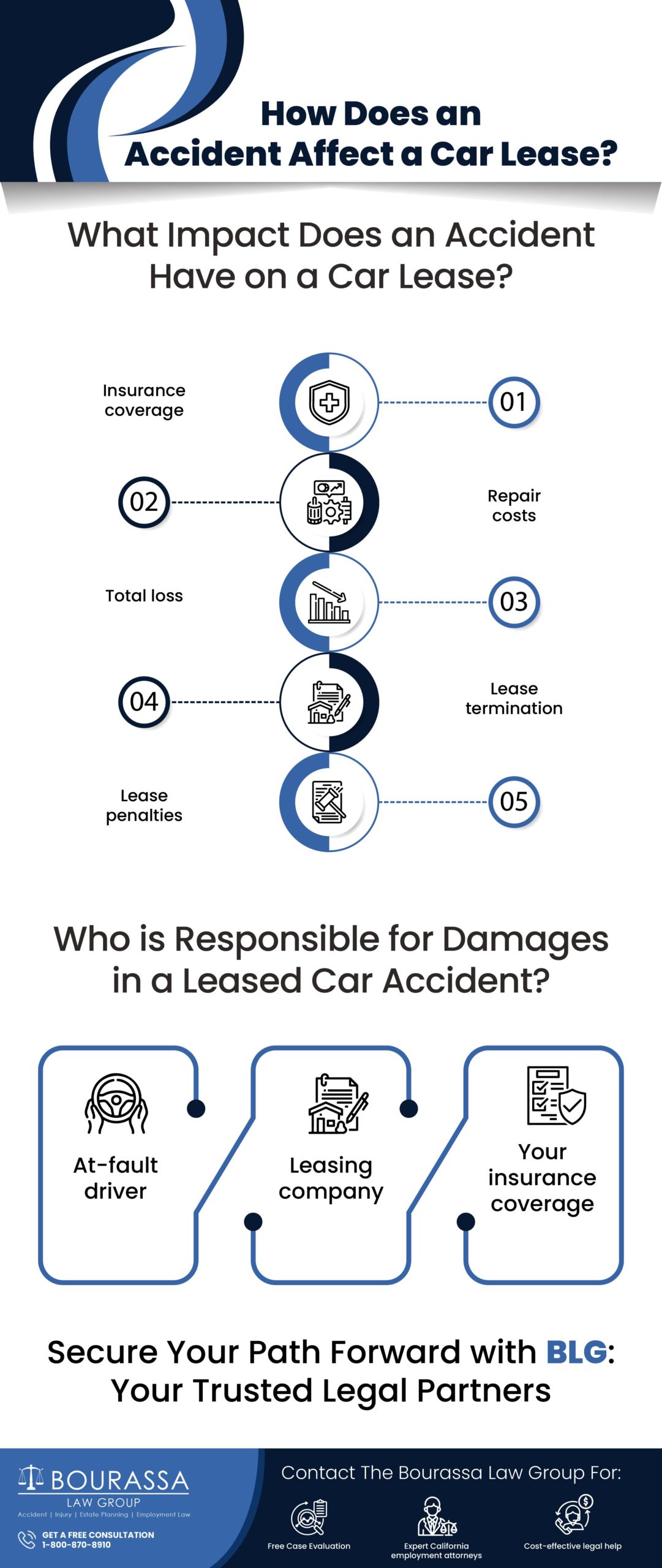

What Impact Does an Accident Have on a Car Lease?

When a leased car is involved in an accident, several factors come into play, and the impact on the lease can vary depending on the accident’s severity, insurance coverage, and the lease agreement terms. Here are some general considerations:

Insurance Coverage:

Most lease agreements require the lessee to maintain comprehensive and collision insurance on the leased vehicle. These coverages typically help repair or replace the car in case of an accident. If the accident is covered by insurance, the insurance company will typically handle the cost of repairs or, in some cases, declare the vehicle a total loss if the damage is extensive.

Repair Costs:

If the car is repairable, the insurance company will assess the damage and cover the cost of repairs minus the deductible. The lessee is usually responsible for paying the deductible. The lease agreement may specify specific guidelines regarding repairs. For example, repairs may need to be performed at an authorized or approved repair facility.

Total Loss:

If the cost of repairs exceeds a certain percentage of the car’s value (often referred to as the “total loss threshold“), the insurance company may declare the vehicle a total loss. In the case of a total loss, insurance typically pays the actual cash value of the car at the time of the accident. The gap between the insurance payout and the remaining lease balance may be covered by gap insurance if the lessee has it.

Lease Termination:

The lease agreement may allow for termination depending on the extent of damage and repair. Some leases have provisions for early termination under specific circumstances, which may include significant damage to the vehicle. In the event of a total loss, the lessee may terminate the lease without further obligations, as the insurance payout can cover the remaining lease balance.

Lease Penalties:

The lease agreement may have provisions related to vehicle condition. Excessive wear and tear, including damage beyond everyday use, may result in additional charges at the end of the lease term. The lessee should carefully review the lease agreement to understand their responsibilities in the event of an accident.

Gap Insurance:

Gap insurance covers the difference between the insurance payout and the remaining lease balance in case of a total loss. It can be beneficial in ensuring that the lessee is not left with a financial burden after an accident.

What Happens if You Crash a Leased Car?

When you crash a leased car, the implications extend beyond the immediate damage to the vehicle. The lease agreement, a legally binding contract between you and the leasing company, outlines your responsibilities in case of accidents. Typically, the leasing company expects the lessee to maintain insurance coverage that includes comprehensive and collision coverage. This leasing company money is crucial because it covers damage to your leased vehicle in an accident and provides protection in case of theft, vandalism, or other non-collision incidents.

What Happens If a Leased Car Gets Totaled?

When a leased car is totaled, several outcomes depend on insurance coverage, the lease agreement terms, and whether the lessee has gap insurance. Here’s a breakdown of what typically happens:

Insurance Assessment: The insurance company assesses the extent of the damage to determine if the vehicle is a total loss. If the cost of repairs exceeds a certain percentage of the car’s value (absolute loss threshold), the insurance company may declare the vehicle totaled.

Insurance Payout: If the car is declared a total loss, the insurance company pays to cover the actual cash value of the vehicle at the time of the accident. Lessees are typically not responsible for the remaining lease payments beyond what the insurance payout covers.

Lease Termination: In many cases, a totaled vehicle allows for the termination of the lease without further obligations. The insurance company covers the remaining lease balance, especially with gap insurance.

Deductibles: Lessees are typically responsible for paying the insurance deductible before receiving the insurance payout. The deductible amount is outlined in the insurance policy and can vary.

Vehicle Recovery: The leasing company may handle retrieving the totaled vehicle. The car insurance company may sometimes purchase the vehicle from the leasing company after the payout.

Lease Cars Insurance Coverage in Nevada?

Understanding the insurance coverage for a leased car in Nevada is paramount for lessees. You must carry specific insurance coverage to protect yourself and the leasing company when you lease a vehicle. Here are key insurance coverages to consider:

Liability Insurance: This coverage is essential and often mandatory. It helps cover the costs of bodily injury and property damage if you are at fault in an accident.

Comprehensive and Collision Coverage: Comprehensive coverage protects against non-collision events such as theft, vandalism, or natural disasters. Collision coverage, on the other hand, covers damages to your leased car in the event of an accident.

Gap Insurance: Gap coverage is another essential form of insurance for lessees. In the unfortunate event of a total loss, gap insurance covers the difference between the car’s actual cash value and the amount remaining on the lease.

Understanding your insurance coverage is vital, as it directly impacts your financial responsibility in the event of an accident. Failure to maintain adequate insurance may result in penalties and legal complications.

Who is Responsible for Damages in a Leased Car Accident?

Determining responsibility for damages in a leased car accident involves assessing the circumstances of the collision and relevant insurance coverage. Here are key considerations:

At-Fault Driver: The other driver’s insurance company is generally responsible for covering damages if another driver causes the accident. However, the extent of coverage depends on the at-fault driver’s insurance policy limits.

Leasing Company: The leasing company may have requirements for the maintenance and repair of the leased vehicle. If the accident is not your fault, the leasing company may be involved in ensuring the car is repaired according to their standards.

Your Insurance Coverage: Your insurance coverage is crucial in covering damages to your leased car and potential medical expenses. However, the specific coverage depends on the types of insurance you carry.

How an Attorney Can Help:

Seeking the assistance of a knowledgeable attorney specializing in car accidents involving leased vehicles is often a prudent step. Here’s how an attorney can provide valuable support:

Insurance Claim Assistance: An attorney can help you navigate the insurance claim process, ensuring you receive the compensation you deserve.

Lease Agreement Review: Understanding the nuances of your lease contract is crucial. An attorney can review the terms and conditions, clarifying your rights and responsibilities.

Negotiating with Leasing Companies: If disputes arise with the leasing company regarding damages, an attorney can negotiate on your behalf to reach a fair resolution.

Legal Representation: In cases where legal action is necessary, having an attorney by your side provides legal representation to pursue compensation for damages, medical bills, and other losses.

Gap Insurance Claims: If your leased car is totaled, an attorney can assist in filing and pursuing gap insurance claims to cover the remaining payments on your lease.

Secure Your Path Forward with BLG: Your Trusted Legal Partners

Navigating the aftermath of a vehicle accident involving a leased vehicle in Nevada requires a comprehensive understanding of the legal landscape, insurance policies, and lease agreements. The impact of an accident on a car lease is not only financial but can also affect your daily life and future obligations.

Seeking legal guidance from experienced professionals ensures you can confidently navigate these complexities, make informed decisions, and secure the compensation you deserve. Remember, in the vast desert landscapes of Nevada, legal support can be the compass that guides you through the challenging terrain of post-accident proceedings.

If you’ve recently experienced a leased car accident and find yourself navigating the complexities of insurance claims, lease agreements, and potential legal disputes, turn to the seasoned experts at BLG. Our dedicated team of attorneys specializes in personal injury and car accidents, offering tailored guidance to protect your rights and secure the best possible outcome.

Contact BLG today for a free consultation.

FAQs

Is it wrong to crash a leased car?

Yes, it is undesirable to crash a leased car. Accidents can result in repair costs and potential lease termination, affecting your insurance rates. It’s crucial to promptly report the incident to your insurance and leasing company, follow the terms of your lease agreement, and ensure repairs are carried out appropriately.

Should I fix the damage before turning in a lease?

In most cases, fixing damage before turning in a leased car is advisable. Lease agreements often stipulate guidelines for vehicle condition, and excessive wear and tear may incur additional charges. Repairing damages before the lease return can help avoid penalties and ensure a smooth end-of-lease process.

Is Nevada a no-fault state for car accidents?

No, Nevada is not a no-fault state for car accidents. Nevada follows a fault-based system, meaning the party at fault is responsible for covering the damages. In accidents, the at-fault driver’s insurance typically handles the claims for their and the other party’s damages.

How long does an at-fault accident stay on your record in Nevada?

The duration for which an at-fault accident stays on your record in Nevada can vary. Generally, at-fault accidents remain on your driving record for three to five years. Insurance companies use this information to assess risk and determine premium rates. It’s advisable to check with the Nevada Department of Motor Vehicles or your insurance provider for specific details.